Condo Insurance in and around Lubbock

Lubbock! Look no further for condo insurance

Quality coverage for your condo and belongings inside

- Lubbock

- Levelland

- Shallowater

- Littlefield

- Abernathy

- Ralls

- Idalou

- Buffalo/Ransom

- Wolfforth

- New Deal

- Slaton

Home Is Where Your Condo Is

When considering different providers, coverage options, and liability amounts for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condo but also your personal belongings within, including clothing, videogame systems, shoes, and more.

Lubbock! Look no further for condo insurance

Quality coverage for your condo and belongings inside

Agent Jane Phillips, At Your Service

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Jane Phillips can be there whenever mishaps occur to help you submit your claim. State Farm is there for you.

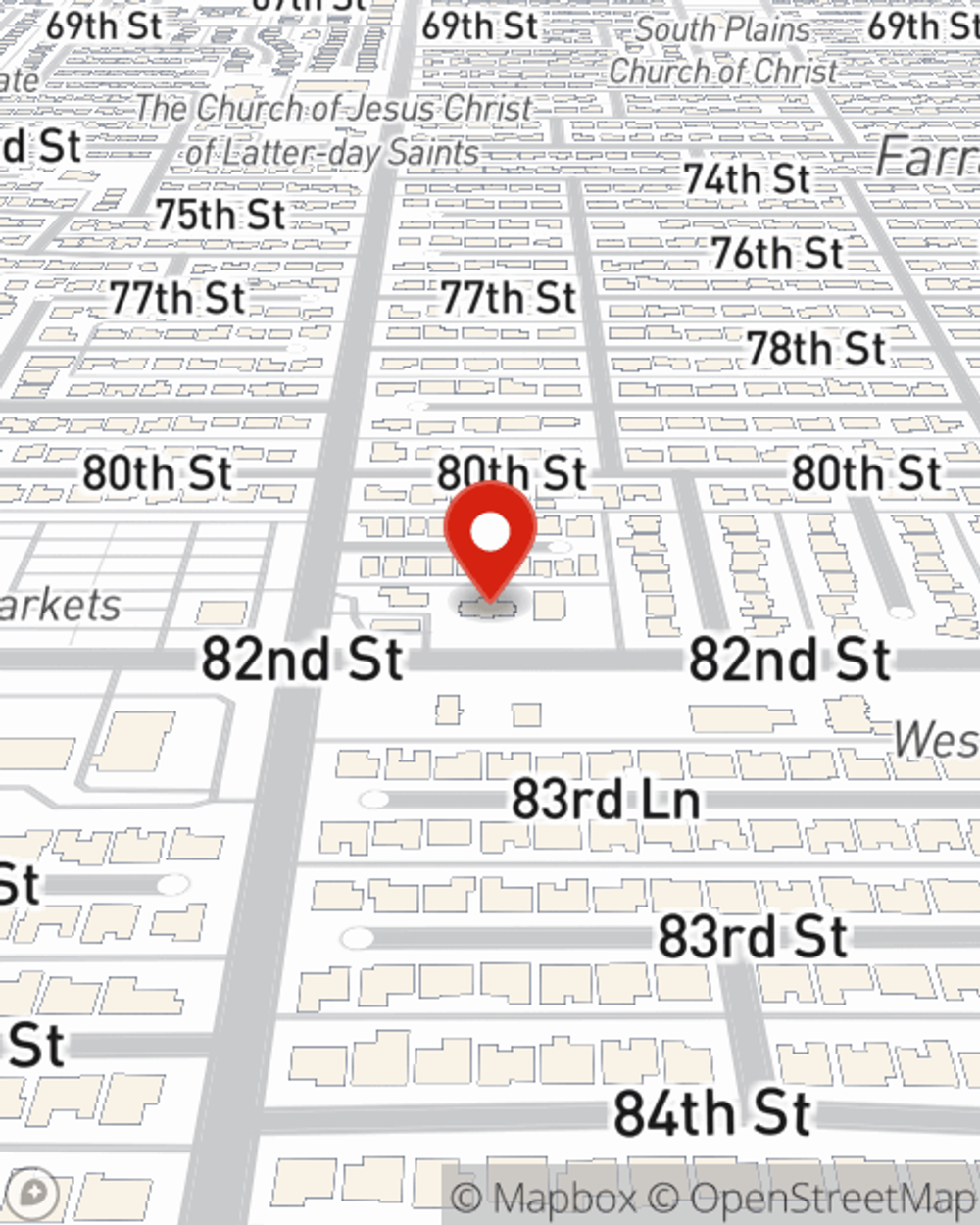

That’s why your friends and neighbors in Lubbock turn to State Farm Agent Jane Phillips. Jane Phillips can outline your liabilities and help you find a policy that fits your needs.

Have More Questions About Condo Unitowners Insurance?

Call Jane at (806) 798-1395 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Jane Phillips

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.